Growth

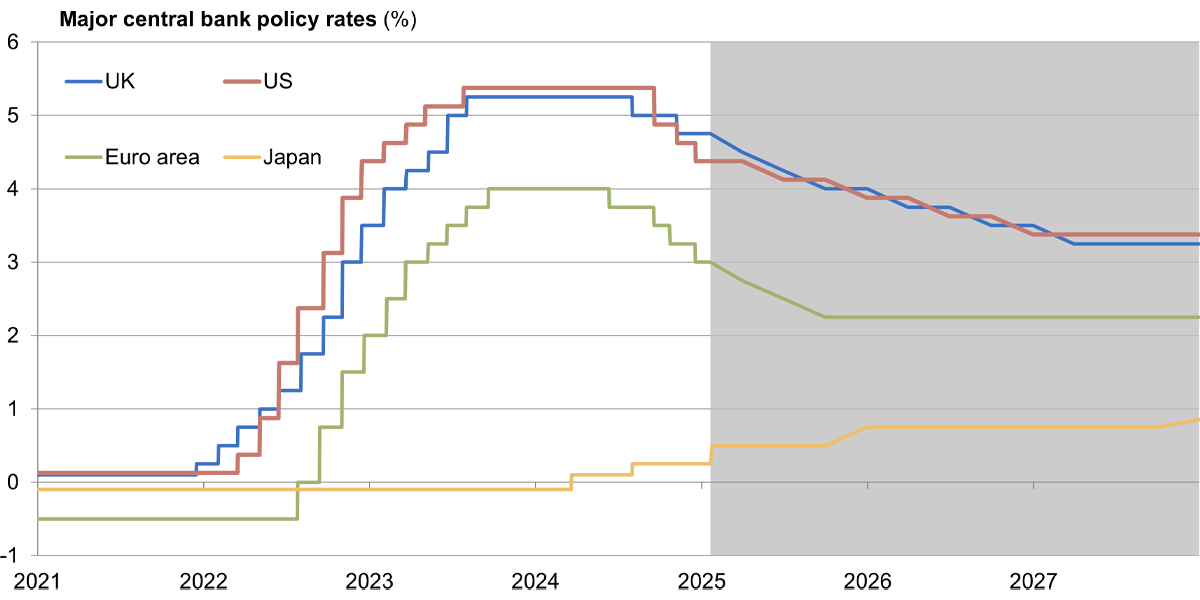

- Uncertainty around the global economic outlook has increased following the election of President Trump

- Should President Trump swiftly follow through on his campaign proposals of sharp tariff hikes (10% on all trading partners & 60% on China) and the deportation of 11 million undocumented immigrants, we would expect the US & global economies to slide into recession

- However, our baseline expects Trump will adopt more targeted tariffs & more modest immigration cuts, which combined with Trump’s pro-growth policies of deregulation & corporate/income tax cuts will keep the US economy on a soft-landing path

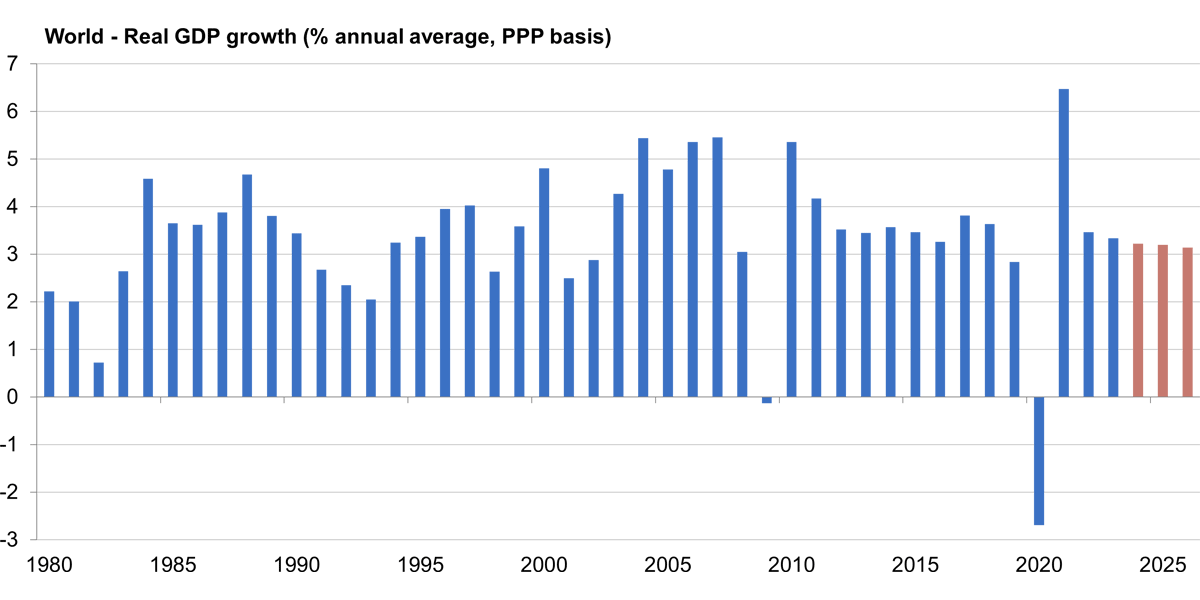

- Global growth is forecast to average around a 3-3¼% pace in 2025 and 2026, close to that seen over the past two years, but ½ ppt below that seen in the decade prior to COVID

- Despite a recent ramp-up in stimulus measures, growth in China is expected remain under pressure, with a further slowdown expected over coming years