Growth

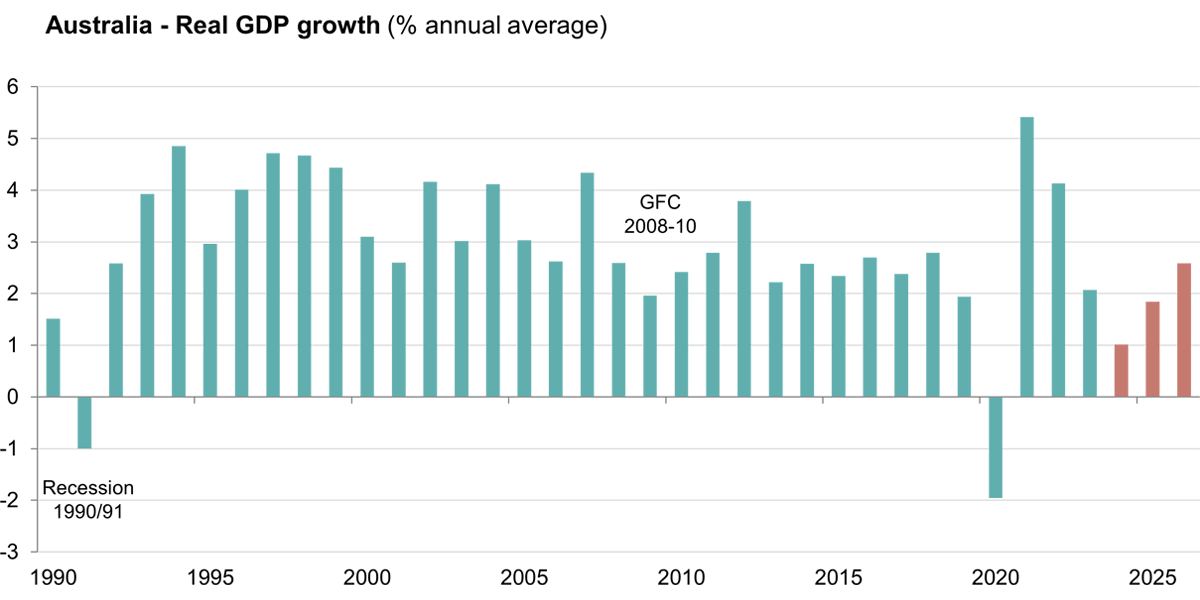

- The Australian economy has been weak, growing well below trend in 2024

- Consumers cut back spending as they faced intense budgetary pressures, with per person real disposable incomes falling by over 10%; double the rate of the 1990/91 recession

- But we are now likely past the trough

- The economy will pick up gradually over 2025, with the recovery gaining traction to around a trend pace by 2026

- Solid population growth, income tax cuts and cost-of-living relief will support the economic recovery