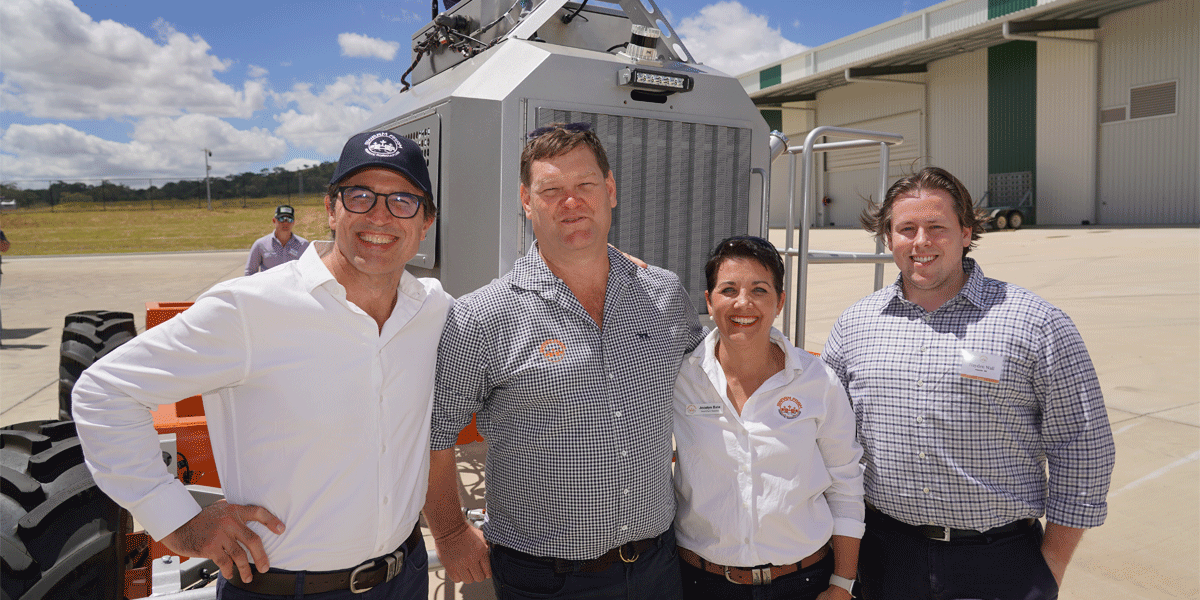

SwarmFarm Robotics founders Andrew and Jocie Bate (centre) join QIC Ventures' Nicholas Guest and Hayden Wall at the new manufacturing facility on the Darling Downs

SwarmFarm Robotics founders Andrew and Jocie Bate (centre) join QIC Ventures' Nicholas Guest and Hayden Wall at the new manufacturing facility on the Darling DownsCentral Queensland Agtech startup SwarmFarm Robotics will make even more autonomous agriculture 'SwarmBots' in Queenland following an investment from the QIC-managed Business Investment Fund.

Central Queensland Agtech startup SwarmFarm Robotics are making even more autonomous agriculture ‘SwarmBots’ in Queensland following an investment from the QIC-managed Business Investment Fund.

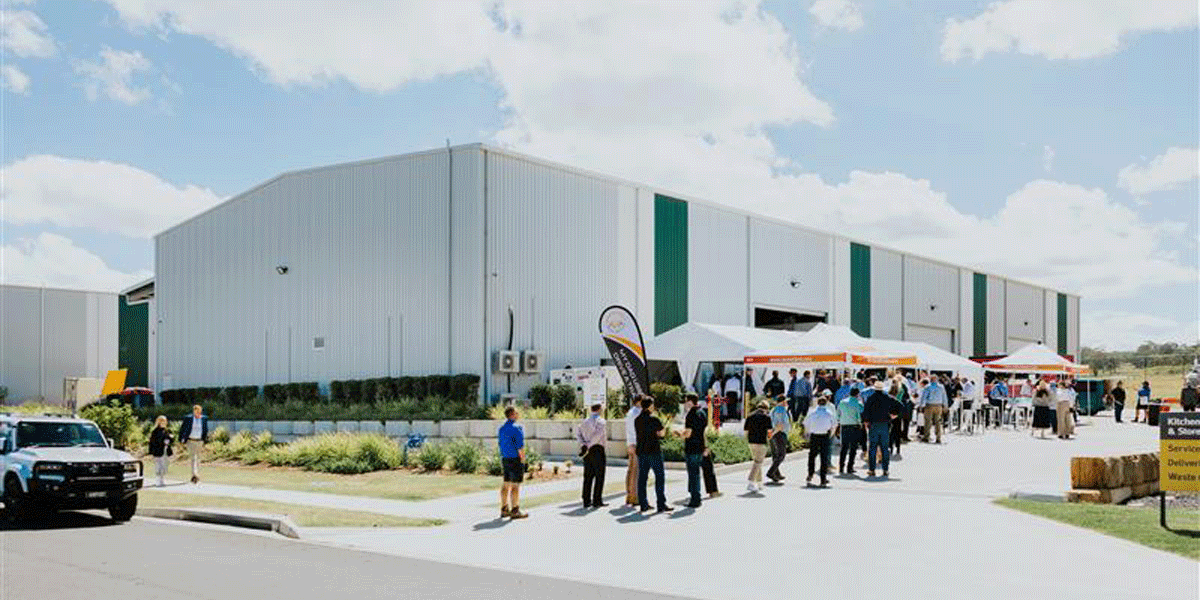

A new manufacturing hub officially opened on the Darling Downs today is allowing the team to deliver on key growth opportunities and strong forward order book with greater capabilities and streamlined production.

Founded in 2010 by husband-and-wife team Andrew and Jocie Bate, the platform replaces large, heavy, and expensive machinery with nimble, lightweight, autonomous robots controlled by a mobile phone app.

QIC Ventures’ Hayden Wall said SwarmFarm continues to exceed expectations, scaling rapidly while streamlining its production processes.

“What started as a back-porch idea on a grain farm in regional Queensland has become a category-defining Agtech success employing more than 55 people and shipping its first SwarmBot to North America,” Mr Wall said.

“The momentum behind autonomous agriculture has never been stronger, and SwarmFarm is leading the charge. With significant commercial traction and growing industry tailwinds, now is the time for scalable, precision-driven farming solutions.

“This latest investment through the Business Investment Fund marks QIC’s third investment in SwarmFarm, and each time, we’ve seen accelerating demand, continued platform expansion, and a deepening impact on the sector globally.

“With scaling and optimising manufacturing now a key priority, the move to the new Darling Downs hub will not only enhance production efficiency but also support the company’s continued growth as it meets rising demand.”

SwarmFarm's new facility at the Wellcamp Business Park on the Darling Downs

SwarmFarm's new facility at the Wellcamp Business Park on the Darling Downs

SwarmFarm’s 145 deployed SwarmBots having already mowed, slashed or sprayed more than seven million hectares of commercial farmland, vineyards and orchards.

By saving farmers more than 300,000 labour hours and optimising precision crop protection, SwarmBots have also displaced over seven million litres of pesticides, reinforcing SwarmFarm’s role in redefining on-farm efficiency and sustainability.1

SwarmFarm Robotics CEO Andrew Bate said every acre a SwarmBot tends to represents a step forward in creating smarter, more environmentally friendly farming practices.2

“Our journey from the fields of regional Queensland to global markets is a testament to the power of innovation, determination and the great people who have joined us on this journey,” Mr Bate said.

“QIC’s investment signifies a pivotal moment in our growth journey and positions us to enhance our manufacturing capabilities, fostering increased opportunities for both technological exports and the skilled workforce of Queensland.

"At SwarmFarm Robotics, we see ourselves not just as creators of robots, but as enablers of progress and new opportunities in agriculture.

“Our commitment to Queensland and our dedication to driving positive change in agriculture remains unwavering as we embark on this next phase of growth."

The $150 million Business Investment Fund, managed by QIC, supports good quality Queensland businesses that need capital to create jobs for Queenslanders.

Business investment funds managed by QIC have invested $167 million into 83 Queensland businesses, creating more than 1,330 jobs.

For more information, visit QIC Ventures.

Citations

- Source: SwarmFarm Robotics | Robotic Agriculture, information as at Feb 21, 2025.

- There is no guarantee that any of the steps taken by QIC and/or third parties to mitigate, prevent or otherwise address material ESG topics will be successful, completed as expected or at all, or will apply to or continue to be implemented in the future.

For further information, please contact:

Ben Brew, Media Lead - Corporate Communications

bbrew@qic.com | +61 477 790 145

Further information

Investing from seed to Series C, QIC Ventures has partnered with more than 80 world-class companies taking Australian innovation global since 2016, including Go1, Gilmour Space and VALD. It sits within the institutional QIC Private Equity platform, which manages A$8.9 billion globally in private equity assets from offices in the US, Europe and Australia.

QIC Limited ACN 130 539 123 (“QIC”) is a wholesale funds manager, and its products and services are not directly available to, and this document may not be provided to any, retail clients. QIC is a company government owned corporation constituted under the Queensland Investment Corporation Act 1991 (QLD). QIC is also regulated by State Government legislation pertaining to government owned corporations in addition to the Corporations Act 2001 (Cth) (“Corporations Act”). QIC does not hold an Australian financial services (“AFS”) licence and certain provisions (including the financial product disclosure provisions) of the Corporations Act do not apply to QIC. Other wholly owned subsidiaries of QIC do hold AFS licences and are required to comply with relevant provisions of the Corporations Act. QIC also has wholly owned subsidiaries authorised, registered or licensed by the United Kingdom Financial Conduct Authority (“FCA”), the United States Securities and Exchange Commission (“SEC”) and the Korean Financial Services Commission. For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

The statements and any opinions in this document (the “Information”) are of a general nature and for commentary purposes only and do not take into account any investor’s personal, financial or tax objectives, situation or needs. The Information is not intended to constitute and should not be relied on as personal legal or investment advice and it does not constitute, and should not be construed as, an offer to sell or solicitation of an offer to buy, securities or any other investment, investment management or advisory services.