QIC Real Estate has made a further commitment to its sustainability goals by successfully converting A$3.75bn of bank loans into Sustainability-Linked Loans (SLLs) for its two largest real estate funds - the QIC Property Fund (QPF) and the QIC Town Centre Fund (QTCF).

These deals combined, form one of the largest REIT SLLs to come to market within Australia in recent years, with a broad range of targets across core retail assets in the two funds. The KPIs seek to address the Funds’ carbon emissions (across scopes 1, 2 and 3), and represent one of the first deals to utilise the Green Building Council of Australia’s new Green Star Performance Tool v2 (released in July 2024).

In addition, these SLLs will see QIC Real Estate targeting Cleaning Accountability Framework certification across both fund’s portfolios to promote industry-leading ethical labour practices.

Deborah Coakley, Managing Director, QIC Real Estate said converting the funding under an SLL is a demonstration of our commitment to managing a resilient real estate portfolio.

“Sustainable finance is an effective and critically important tool to deliver sustainability goals in a commercially responsible way,” Ms Coakley said.

“These SLLs build on QIC Real Estate’s track record in sustainable finance, having issued a A$300m Climate Bond Initiative (CBI) certified Green Bond in 2019 for the QIC Town Centre Fund – a world-first for the retail property sector. QTCF has outperformed its targets under the Bond, which is due to be repaid in 2025.”

Briar Dowsett, QPF Fund Manager, QIC, said this new SLL is in line with client-endorsed strategies and further strengthens QIC Real Estate’s focus on material environmental and social issues and high standards of governance.

“This is the culmination of a significant project across our two largest real estate funds and a demonstration of our ability to enact on client-endorsed strategies and partner with our lending group,” Ms Dowsett said.

“The targets under this SLL will provide further momentum for us to deliver on our ESG objectives and support our clients in meeting their sustainability goals.”

ANZ, CBA, and MUFG acted as joint sustainability coordinators on the transaction.

The Sustainability-Linked Loans have key performance indicators linked to their interest rate margins and have been developed under QIC Real Estate’s inaugural Sustainable Finance Framework, which will be applied to all future SLLs and any other future sustainable financing instruments.

A Second Party Opinion was procured from DNV, confirming the loans were issued in alignment with the Sustainability Linked Loan Principles 2023 and confirming the ambition of the chosen sustainability performance targets.

Jo Scotney, ANZ General Manager, Institutional Property and Health, said: “ANZ is pleased to support QIC Real Estate as they embed sustainability targets into the financing arrangements for their two largest real estate funds. The Sustainability-Linked Loans have been structured with targets designed to drive continuous improvement across a range of environmental and social considerations that are material to the funds. These transactions reinforce QIC Real Estate’s strong commitment to ESG and desire to contribute to the communities in which they operate.”

Charles Davis, Head of ESG and Sustainable Finance at CBA said “CBA are proud to support QIC in the development of their sustainable finance framework and the conversion of facilities to Sustainability-Linked Loans. The transactions reflect QIC’s ongoing commitment to improving environmental and social outcomes through innovative targets. The targets demonstrate QIC’s willingness to tackle challenging sustainability issues, not only within its own operations, but also its value chain, through inclusion of scope 3 and CAF related targets.”

Rob Ward, Head of Asian Investment Banking Division, MUFG, Oceania, congratulated QIC on the milestone achievement, saying “This landmark transaction highlights QIC’s leadership in the Australian real estate sector and its commitment to advancing ESG goals. The introduction of an overarching Sustainability Finance Framework provides a platform for QIC Real Estate’s future ESG and financing strategies.”

Citations

- Issued by the Asia Pacific Loan Market Association, Loan Markets Association and Loan Syndications & Trading Association

- ANZ, CBA and MUFG acted as joint sustainability coordinator for the QPF transaction, and ANZ and CBA for the QTCF transaction

For further information, please contact:

Further information

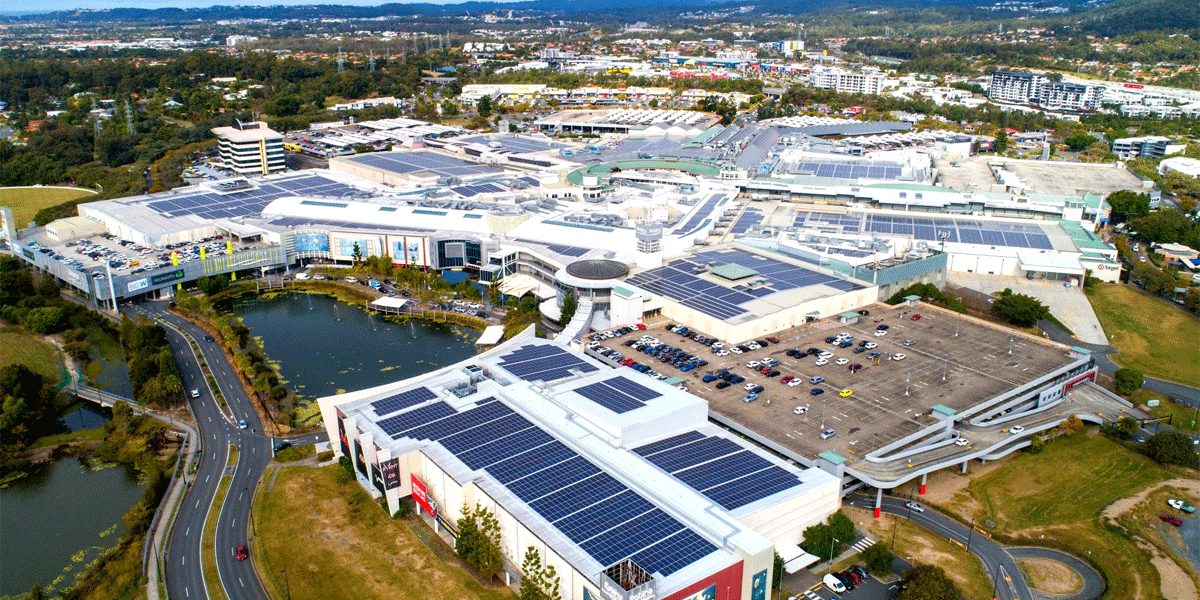

QIC Real Estate manages a A$13.6bn portfolio across 40 retail, commercial and industrial properties in Australia on behalf of our institutional investment clients. QIC Real Estate’s management and investment approach centres on creating vibrant places at the heart of communities, where people choose to be, and where they feel proud to belong.

About QIC*

QIC is a long-term specialist manager in alternatives offering infrastructure, real estate, private capital, private debt, natural capital, liquid strategies and multi-asset investments. It is one of the largest institutional investment managers in Australia, with A$111bn (US$72bn) in funds under management. QIC has over 900 employees and serves approximately 115 clients. Headquartered in Brisbane, Australia, QIC also has offices in Sydney, Melbourne, New York, San Francisco, London and Singapore. For more information, please visit: www.qic.com.

*As at 30 June 2024

QIC Limited ACN 130 539 123 (“QIC”) is a wholesale funds manager, and its products and services are not directly available to, and this document may not be provided to any, retail clients. QIC is a company government owned corporation constituted under the Queensland Investment Corporation Act 1991 (QLD). QIC is also regulated by State Government legislation pertaining to government owned corporations in addition to the Corporations Act 2001 (Cth) (“Corporations Act”). QIC does not hold an Australian financial services (“AFS”) licence and certain provisions (including the financial product disclosure provisions) of the Corporations Act do not apply to QIC. Other wholly owned subsidiaries of QIC do hold AFS licences and are required to comply with relevant provisions of the Corporations Act. QIC also has wholly owned subsidiaries authorised, registered or licensed by the United Kingdom Financial Conduct Authority (“FCA”), the United States Securities and Exchange Commission (“SEC”) and the Korean Financial Services Commission. For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

The statements and any opinions in this document (the “Information”) are of a general nature and for commentary purposes only and do not take into account any investor’s personal, financial or tax objectives, situation or needs. The Information is not intended to constitute and should not be relied on as personal legal or investment advice and it does not constitute, and should not be construed as, an offer to sell or solicitation of an offer to buy, securities or any other investment, investment management or advisory services.