QIC has received outstanding scores of 100/100 for its Infrastructure and Liquid Markets Groups (Fixed Income – SSA, Corporate and Securitised modules), and a significant increase to 98 for Real Estate – up 15 on the previous year – for its responsible investment activities from the UN-supported finance sector investor network, Principles for Responsible Investment (PRI) in 2024.1

QIC’s Executive Director ESG, Rowan Griffin said the PRI benchmarking survey is a valuable gauge of our ESG performance at a point in time across our business.

“It helps compare our performance against peers and enables us to identify areas for improvement, and the results this year for our Infrastructure, Liquid Markets and Real Estate Groups are particularly impressive,” Mr Griffin said.

“Each of our investment teams saw a lift in their scores, which is a strong demonstration of their continued focus on ESG integration.”

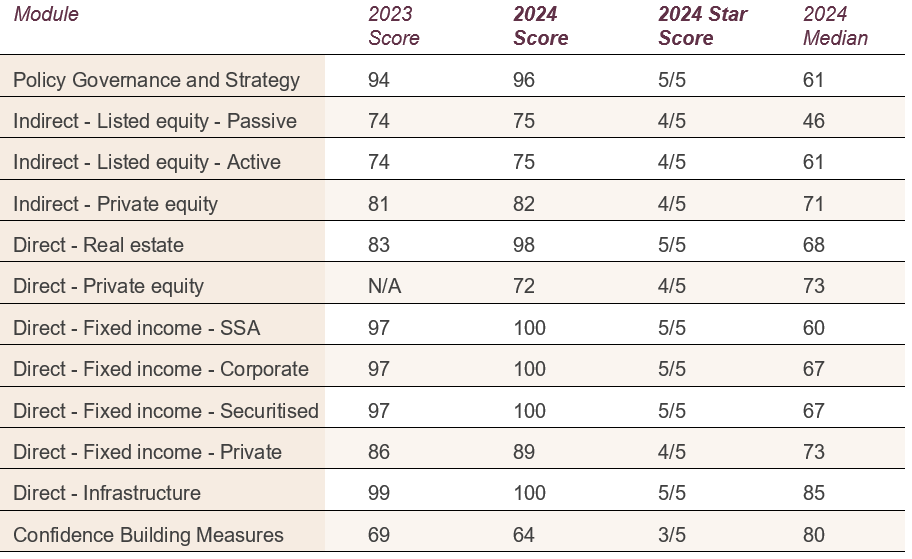

Across all areas assessed, QIC scored above the median for 10 out of our 12 modules, with half achieving the highest category ranking of five stars.

Mr Griffin said these results reflect the continued momentum on ESG integration and strategy across the business.

“QIC has been a signatory to the Principles for Responsible Investment since 2008 and we participate annually in this benchmark survey,” he said.

Our PRI results provide our clients with an objective view of our performance.”

Other results for the business include in our Private Equity Group where QIC reported under a second category for Private Equity for the first time (Direct – Private Equity) and received 72/100 (4 stars) a pleasing outcome for the first reporting period. Private Equity also increased their Indirect score from 81 in 2023 to 82 this year.

QIC continued to score very highly for our Policy, Governance and Strategy module, increasing our score by 2 to 96/100. The full table of results can be found below.

The PRI 2024 results reflect the 2023 reporting period.

The PRI’s goal is to work to achieve a sustainable global financial system by encouraging adoption of the Principles and collaboration on their implementation; by fostering good governance, integrity and accountability; and by addressing obstacles to a sustainable financial system that lie within market practices, structures and regulation.

Mr Griffin said, as stewards of our clients’ capital, QIC seeks to manage our ESG risks and play a part in investment solutions that deliver asset and portfolio resilience and value beyond financial returns.

“We understand that ESG issues vary in materiality across asset classes, sectors and industries and we target our ESG approach to what is suitable for the investment. The range of ESG activity occurring across our teams reflects our ongoing efforts to further embed ESG to make better informed decisions, while delivering on our long-term investment obligations,” he said.

Some recent sustainability highlights across the QIC business include:

- Delivered QIC’s first Climate Transition Plan (post reporting period) establishing interim targets and decarbonisation pathways in line with our NZAM commitments.

- Approved and piloted a conceptual Sustainable Investment Framework providing guidance for sectors and topics of strategic focus or with elevated risk

- Participated as a collaborating investor on PRI’s pilot “Sovereign Engagement on Climate Change” Australian pilot

- Enhanced our focus on infrastructure resilience, forming an innovative partnership to pilot the new UN Disaster Risk Reduction resilient infrastructure scorecard at two assets

Table: QIC PRI Results 2024

Read our PRI Summary Scorecard 2024 here.

Citations

- QIC is a signatory to UN PRI and pays an annual fee.