Download the PDF

In this insight paper we discuss the need for investment in infrastructure resilience to maintain the reliability, performance levels, safety and continuity of infrastructure assets in the face of physical climate risks.

Historically, infrastructure planning has not always fully considered the inter-dependent nature of infrastructure systems or the complex risks and cascading effects of disasters. Effective mitigation requires collaboration between public and private sectors, with a collective approach to addressing risks and safeguarding communities.

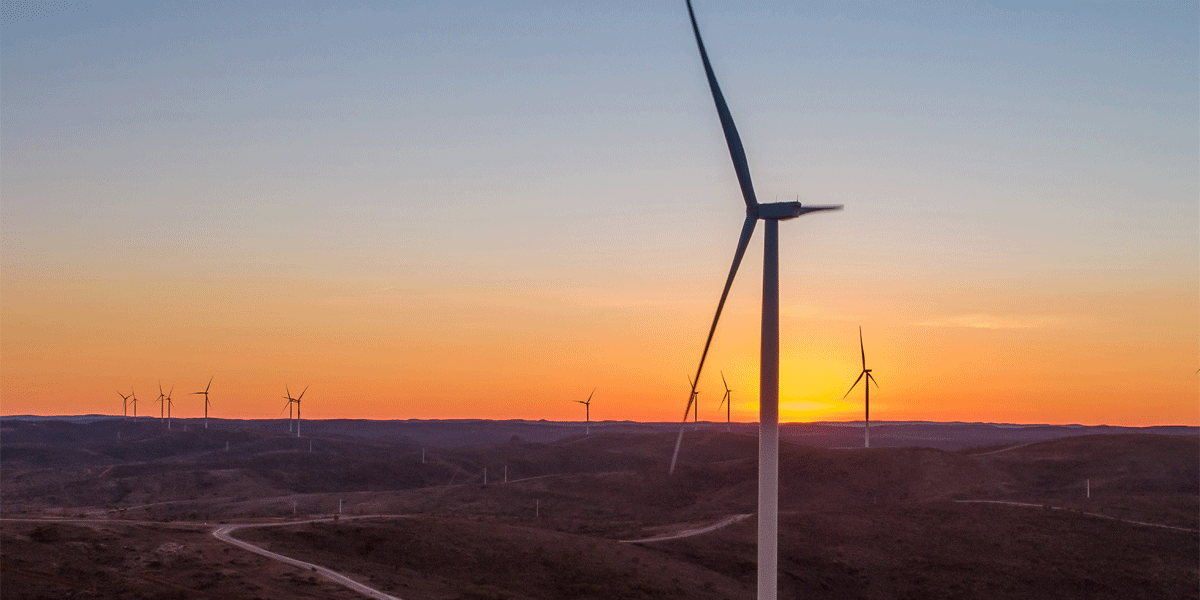

Following the successful pilot conducted by QIC Infrastructure, together with Aurecon, to undertake climate resilience assessments using the UNDRR Disaster Resilience Scorecard at two portfolio assets (Port of Brisbane and Silverton Wind Farm), we have been awarded significant grant funding from the Disaster Ready Fund to Enhance Infrastructure Resilience.

The funding will support our implementation of the ‘Investment in Infrastructure Resilience’ (IIIR) guidebook, which is designed to support investors to assess the resilience of infrastructure assets and identify opportunities to reduce direct and external disaster risk and prevent impacts to communities and infrastructure services.

The IIIR initiative represents a forward-thinking approach, emphasising the importance of collective action and shared responsibility. The initiative aims to create a more resilient infrastructure network that can withstand the challenges posed by climate change and natural disasters.

Further information

QIC Limited ACN 130 539 123 (“QIC”) is a wholesale funds manager and its products and services are not directly available to, and this communication is not intended for, retail investors. For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

Do not copy, disseminate or use, except in accordance with the prior written consent of QIC.