Download the PDF

This paper is a refreshed version of the original publication released in June 2024. It includes updated insights and revisions to reflect the most current information available.

- The J.P. Morgan Asia Credit Index (JACI) suite of indices expanded to include a new JACI Asia Pacific Index (JACI APAC) in 2023. The new index includes USD-denominated debt from the Asia Pacific region, expanding coverage of the existing JACI series by introducing new markets including Japan, Australia and New Zealand.

- The inclusion of Australia in JACI APAC provides investors with additional incentive to consider bonds from Australian corporate issuers in USD, presenting an opportunity to further diversify portfolios with exposure to high-quality, stable issuers.

- Investors can, however, replicate JACI APAC’s Australian credit allocation with a USD-hedged investment into AUD credit and, in doing so, can achieve a higher yield, higher credit quality and greater diversification.

- Actively monitoring AUD and USD debt valuations through time and actively managing security selection can add additional value.

- The AUD corporate credit market enjoys healthy liquidity, which has deepened recently as record volumes of primary market activity have been met with robust investor demand.

- We attribute some of the strong demand to new allocations from Asian investors, who are drawn to the relatively attractive yields and spreads on offer for investment grade credit in a developed market.

With an overlapping time zone, strong governance standards, an actively traded G10 currency and relatively attractive yields, Australian fixed income has long held the interest of Asian investors.

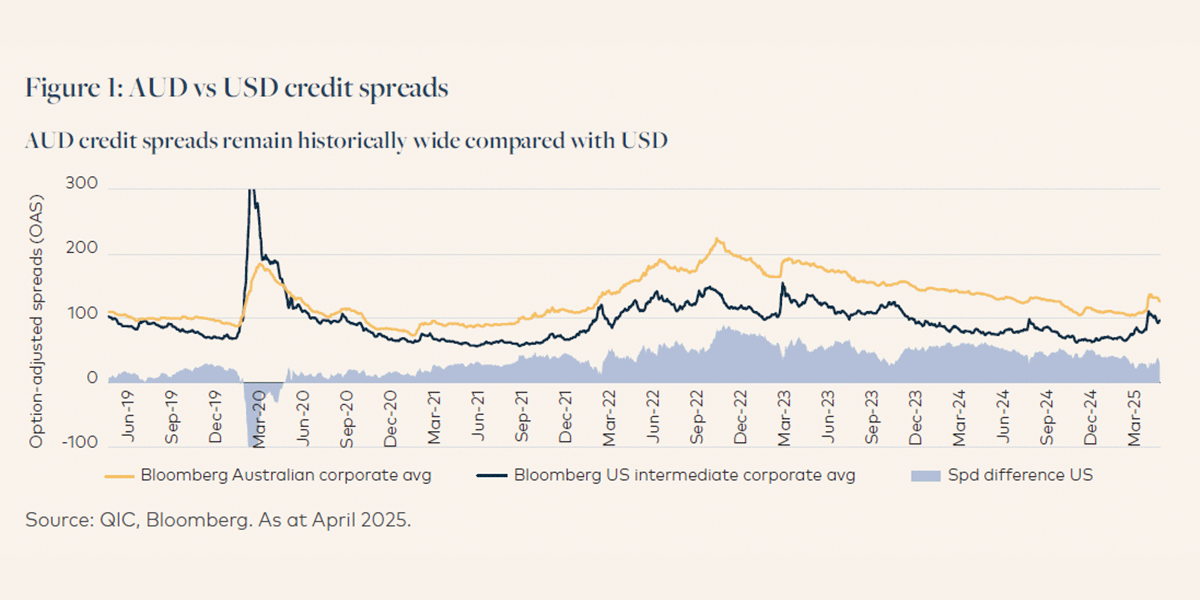

The Australian investment grade (IG) credit market currently presents a particularly compelling opportunity for offshore investors, as AUD credit spreads remain relatively wide despite the significant tightening of credit spreads in other major developed markets (refer to Figure 1). With this attractive relative value in AUD credit we have seen a notable increase in Asian investor interest in the local market over the last 18 months.

Relative value for AUD credit

Credit spreads globally have meaningfully tightened since the Federal Reserve pivot in the second half of 2023. Over this same period AUD credit spreads also tightened, consistent with the global trend.

However, the rally in AUD credit has lagged the strength in USD credit, leaving AUD credit spreads persistently wider (refer to Figure 1). As such, a rotation into AUD-denominated credit has provided international investors with a compelling opportunity, especially when the higher credit quality and shorter duration of AUD credit are considered alongside the wider spreads.

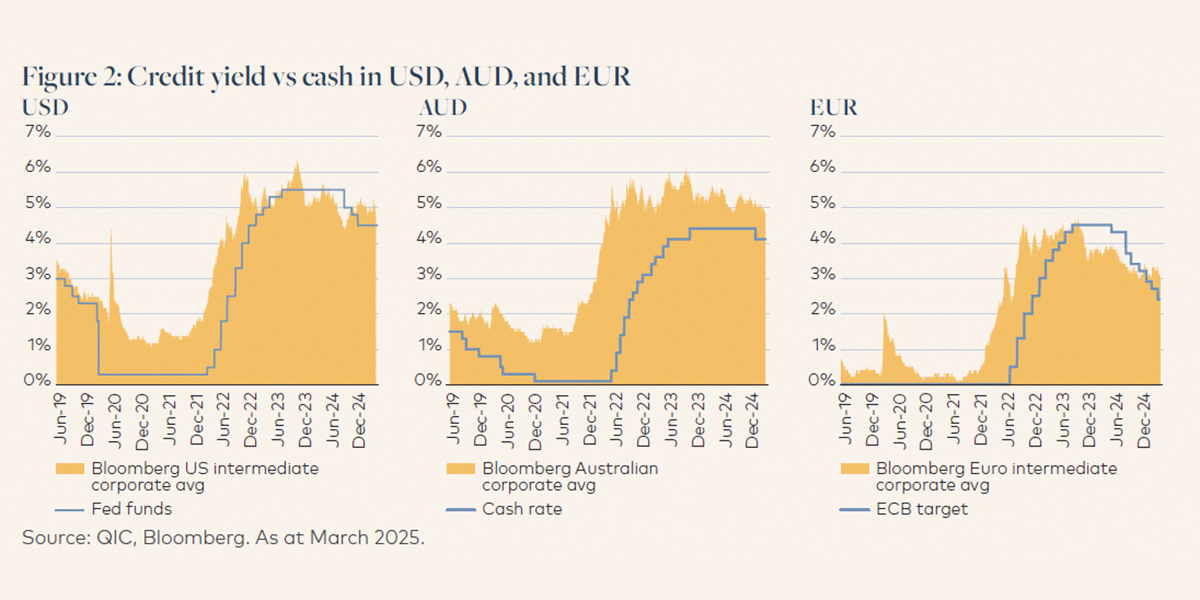

In a further demonstration of the relative attractiveness compared with USD and EUR credit, AUD remains the only market where credit benchmark yields are meaningfully and consistently above cash rates, a position it has maintained since 2019 (see charts below).

The relative value of AUD credit compared with other assets classes is also worth highlighting. With IG credit yields around 10-year highs, they are — somewhat unusually — currently offering a more attractive income than dividends expected from ASX 200 stocks (refer to Figure 3).

The example below, using the Commonwealth Bank of Australia at the issuer level, demonstrates how investors can earn a similar yield to equity with lower risk by moving up the capital structure into debt issuance, given the high yields currently on offer.

Liquidity of AUD credit

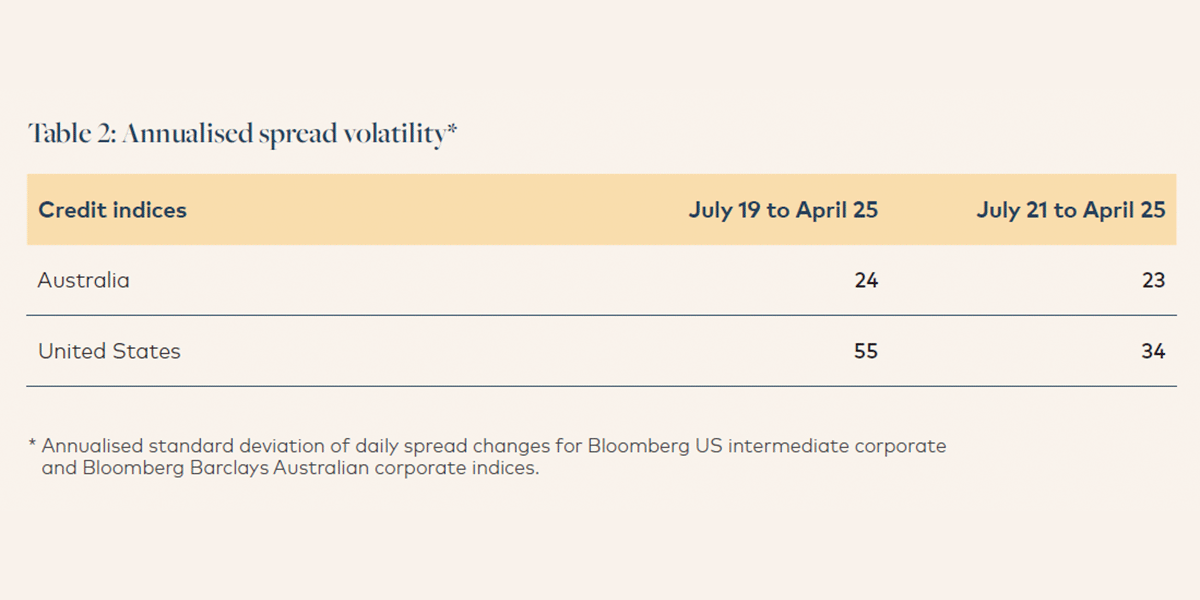

The performance of AUD credit spreads typically lags that of the larger offshore developed market peers, namely the US and European markets, in both widening and tightening cycles.

While this difference is suggestive of lower volatility (see table above), which may be attributable to a higher average credit quality, to some extent it may also be perceived as reflecting lower liquidity compared with the deeper US and European markets.

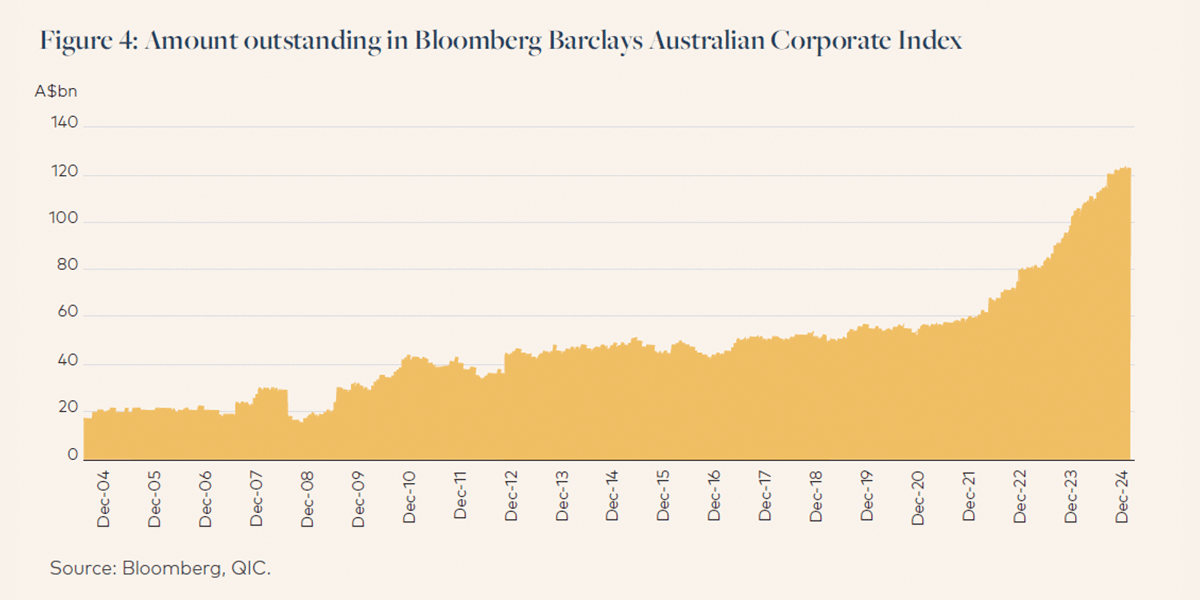

However, we have observed liquidity in AUD credit pick up markedly post-COVID as the overall size of the market has grown and has attracted more participants — particularly from offshore. This interest in turn has encouraged more issuance, in a virtuous cycle. Anecdotally, brokers are also reporting increased secondary trading volumes, which is consistent with the increased primary market activity.

Growth in market size

The growth of the overall AUD credit market can be illustrated by observing the growth of amount outstanding in the Bloomberg Barclays Australian Corporate Index, as seen in Figure 4. This growth is a reliable proxy for the wider IG AUD credit market, which we estimate has grown to around A$550bn.

Growth in investor participation

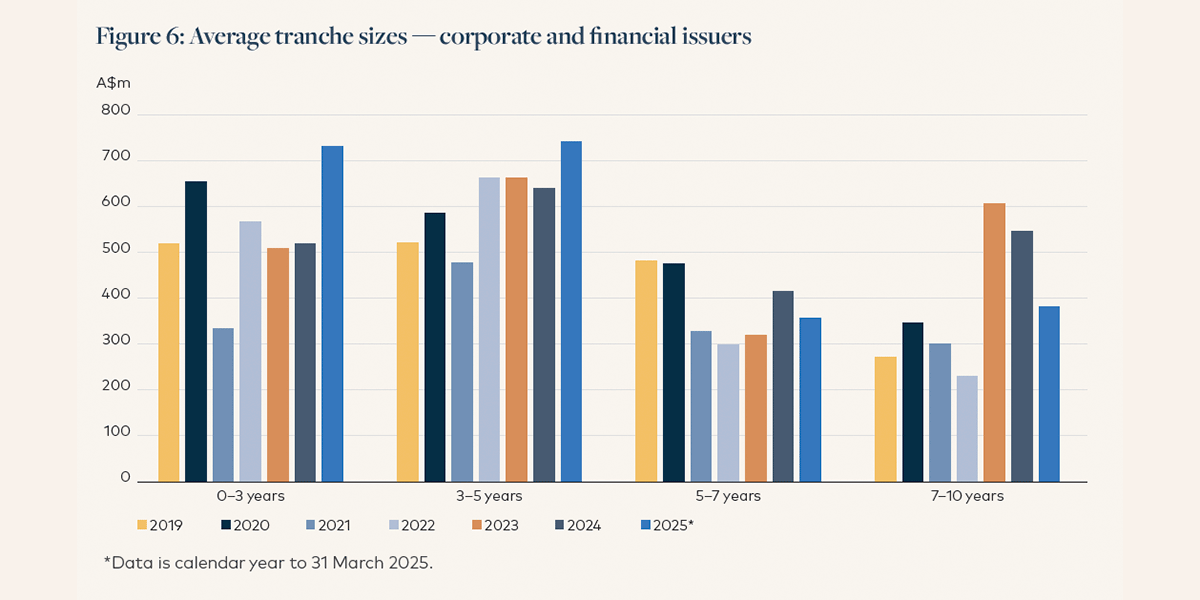

Wider participation in AUD credit markets is evident by the notable increase in primary market orderbooks, with deal oversubscription rising significantly (a result that is even more remarkable considering the large increase in overall issuance volumes). Average tranche sizes have also increased, commensurate with the market’s growth, offering deeper liquidity on each line (refer to Figures 5 and 6).

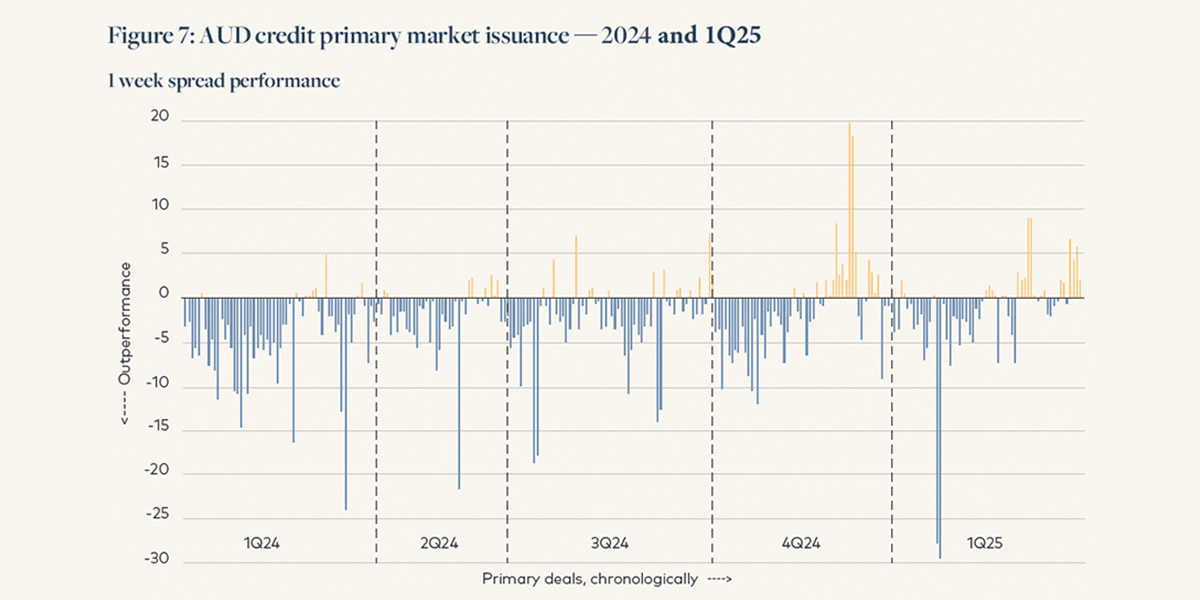

The strong demand and oversubscription in AUD primary markets has seen new issues pricing with

increasingly smaller concessions, a dynamic which can be observed in subsequent secondary

market performance in our view (refer to Figure 7). Active management provides the flexibility for

selective participation in the most attractive primary market deals.

Source: QIC, Bloomberg, Performance is 1 week post issuance spread performance relative to AusBond Credit Index for CY24 and 1Q25.

Source: QIC, Bloomberg, Performance is 1 week post issuance spread performance relative to AusBond Credit Index for CY24 and 1Q25.

AUS credit opportunities relative to Australian issuance in JACI APAC

The JACI APAC Index included USD-denominated bonds of 40 Australian issuers at 31 March 2025 (the “Australian allocation”).

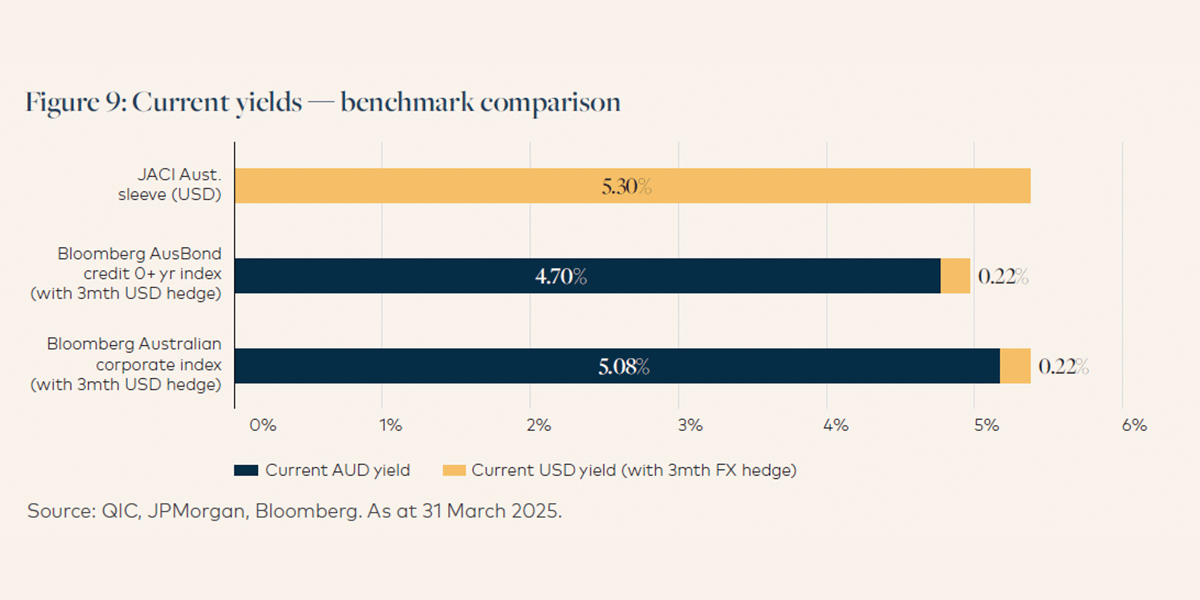

Investing in AUD credit and hedging to USD as an alternative to JACI’s USD-denominated Australian allocation, can provide higher yields while also offering lower risk (i.e. higher average credit quality,

lower duration, greater diversification).

The credit exposure in JACI APAC’s Australian allocation can be replicated by investing in the 19 index constituents that also issue in AUD, or by substitution with a broader and more diversified portfolio of AUD credit:

- Direct investment in the 19 JACI APAC constituents that also issue in AUD offers higher spreads in the local currency than in USD, a reversal of the home market bias often observed in global credit markets. The chart below shows spreads over government bonds for the USD-denominated issuance of Australian constituents in the JACI APAC relative to AUD issuance from those same issuers.

- Substitution of the Australian allocation of the JACI APAC Index with a more diversified portfolio of AUD credit offers the ability to achieve a comparable hedged yield, but with lower duration, greater diversification and a higher average credit rating.

Other advantages

Time zone synergy

The common time zone with Asian markets facilitates real-time communication and transactions, providing a strategic advantage for investors in Asia. This synergy enhances the efficiency of investment decisions and market access, making it easier for Asian investors to engage with the Australian market.

Engaging an Australian fund manager can provide Asian investors convenient access to local market experts, including strategists, traders, portfolio managers and Australian-based credit analysts.

Governance and currency stability

Australia’s governance standards are robust. This is demonstrated through stable sovereign credit ratings of AAA/Aaa/AAA from Standard and Poor’s, Moody’s and Fitch together with strong governance rankings in the 93rd percentile (above the United States at 78.8%) from the World Bank’s latest data set of Worldwide Governance Indicators.1

The Australian dollar is an actively traded G10 currency that benefits from Australia’s strong economic fundamentals, prudent fiscal policies and robust legal framework. This stability is a key factor for investors seeking to minimise currency risk in their international investments.

Conclusion

The Australian credit market stands out as an attractive investment destination for Asian investors, offering a combination of historically attractive credit spreads and yields, governance strength, time zone alignment and hedging efficiency.

Citations

- Daniel Kaufmann and Aart Kraay (2024). Worldwide Governance Indicators, 2024 Update (www.govindicators.org), Accessed on 07 May 2025

Further information

QIC is a sovereign investor and international investment manager with 30+ year track record managing Australian fixed income through its Liquid Markets Group. As a large and long-standing participant in Australian fixed income markets, we have a deep understanding of Australian credit. Our inhouse derivative overlays capability provides the capacity to deliver bespoke hedging solutions — such as currency, duration or synthetic credit — to meet the varied objectives of both local and offshore investors.

QIC Limited ACN 130 539 123 (“QIC”) is a wholesale funds manager and its products and services are not directly available to, and this document may not be provided to any, retail clients. QIC is a company government owned corporation constituted under the Queensland Investment Corporation Act 1991 (QLD). QIC is also regulated by State Government legislation pertaining to government owned corporations in addition to the Corporations Act 2001 (Cth) (“Corporations Act”). QIC does not hold an Australian financial services (“AFS”) licence and certain provisions (including the financial product disclosure provisions) of the Corporations Act do not apply to QIC. Other wholly owned subsidiaries of QIC do hold AFS licences and are required to comply with relevant provisions of the Corporations Act. QIC also has wholly owned subsidiaries authorised, registered or licensed by the United Kingdom Financial Conduct Authority (“FCA”), the United States Securities and Exchange Commission (“SEC”) and the Korean Financial Services Commission. For more information about QIC, our approach, clients and regulatory framework, please refer to our website www.qic.com or contact us directly.

To the extent permitted by law, QIC, its subsidiaries, associated entities, their directors, officers, employees and representatives (“QIC Parties”) give no warranty of any nature whatsoever in relation to the information contained in this document (“Information”) and disclaim all responsibility and liability for any loss or damage of any nature whatsoever (including without limitation any consequential loss) which may be suffered by any person directly or indirectly through the provision to, or use by any person of the Information, including whether that loss or damage is caused by any fault or negligence or other conduct of the QIC Parties or otherwise. Accordingly, you should not rely on the Information in making decisions in relation to your current or potential investments. This Information is general information only and does not constitute financial product advice. You should seek your own independent advice and make your own independent investigations and assessment, in relation to it. In preparing this Information, no QIC Party has taken into account any investor’s objectives, financial situations or needs and it may not contain all the information that a person considering the Information may require in evaluating it. It should not be relied upon by investors. Investors should be aware that an investment in any financial product involves a degree of risk and no QIC Party, nor the State of Queensland guarantees the performance of any QIC fund or managed account, the repayment of capital or any particular amount of return. No investment with QIC is a deposit with or other liability of any QIC Party.

The Information may be based on information and research published by others. No QIC Party has confirmed, and QIC does not warrant, the accuracy or completeness of such statements. Where the Information relates to a fund or services that have not yet been launched, all Information is preliminary information only and is subject to completion and/or amendment in any manner, which may be material and without notice. It should not be relied upon by potential investors.

The Information may include simulations, examples or opinions, or statements and estimates in relation to future matters, many of which will be based on subjective judgements, assumptions as to future events or circumstances, or proprietary internal modelling. No representation is made that such statements or estimates will prove correct. The reader should be aware that such Information is predictive in character and may be affected by inaccurate assumptions and/or by known or unknown risks and uncertainties and should independently investigate, consider and satisfy themselves in relation to such matters. Forecast results may differ materially from results or returns ultimately achieved.

Past performance is not a reliable indicator of future performance.

The Information is being given solely for general information purposes. It does not constitute, and should not be construed as, an offer to sell, or solicitation of an offer to buy, securities or any other investment, investment management or advisory services, including in any jurisdiction where such offer or solicitation would be illegal. This Information does not constitute an information memorandum, prospectus, offer document or similar document in respect of securities or any other investment proposal. The Information is private and confidential. It has not been and is not intended to be deposited, lodged or registered with, or reviewed or authorised by any regulatory authority in, and no action has been or will be taken that would allow an offering of securities in, any jurisdiction. Neither the Information nor any presentation in connection with it will form the basis of any contract or any obligation of any kind whatsoever. No such contract or obligation in connection with any investment will be formed until all relevant parties execute a written contract and that contract will be limited to its express terms. QIC does not make any representation with respect to the eligibility of any recipients of the Information to acquire securities or any other investment under the laws of any jurisdiction. Neither the Information nor any advertisement or other offering material is or may be distributed or published in any jurisdiction, except under circumstances that will result in compliance with any applicable laws and regulations.

Investors or prospective investors should consult their own independent legal adviser and financial, accounting, regulatory and tax advisors regarding this Information and any decision to proceed with any investment in connection with the Information.

Your receipt and consideration of the Information constitutes your agreement to these terms.

This document contains Information that is proprietary to the QIC Parties. Do not copy, disseminate or use, except in accordance with the prior written consent of QIC.